In recent years, China has emerged as a significant global player in the pharmaceutical sector, not only due to its vast market potential but also because of its evolving intellectual property (IP) framework. To further encourage innovation in life sciences, particularly pharmaceutical development, since 2021, China has published or promulgated a series of draft rules for public review and new laws and rules on data exclusivity, supplementary data, patent term adjustment (PTA), patent term extension (PTE), patent linkage and centralised drug procurement. Among the most pivotal developments in this framework, patent linkage marks a substantial shift in how pharmaceutical patents are managed and enforced in China. In this article, we provide a comparison between the patent linkage systems in China and the US, recent trends and decisions related to China’s patent linkage system and the implications for pharmaceutical patent strategies in China.

A brief introduction of the patent linkage system in China

The marketing authorisation holders (MAH) of originator drugs can list their patents covering the originator drugs on a patent linkage platform. Generic applicants (abbreviated new drug application (ANDA) filers) must submit one of the following four types of certifications for each patent listed along with the ANDA and inform the MAH:

Type 1: no patent information related to the reference-listed drug (brand-name drug) on the Registration Platform.

Type 2: the patent has been terminated or declared invalid, or the generic drug applicant has obtained a patent licence from the patentee.

Type 3: the generic drug applicant promises that the generic drug will not be marketed before the expiration of the listed patent.

Type 4: the patent shall be declared invalid (Type 4.1), or the generic drug is not covered by the protection scope of the patent (Type 4.2).

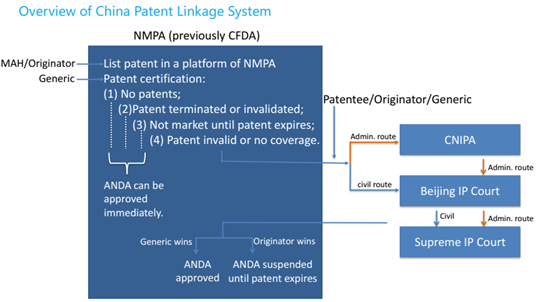

Subsequently, the patentee or originator is able to initiate the administrative route or civil route according to the type 4 certification made by the generic, while the generic may take legal action with the court for confirmation that the drug applied for registration does not fall into the protection scope of the related patent right if the patentee or interested party fails to take legal action within the time limit. See the overview of China patent linkage system (Figure 1), as follows:

Figure 1

Comparison between the patent linkage systems in China and the US

The patent linkage systems in China and US exhibit the following similarities aimed at balancing the interests of originator drugs and generic applicants while promoting drug innovation and ensuring public access to affordable medications:

Patent information registration system: both China and US maintain a system for registering patent information. In China, this is done through a drug patent information registration platform, similar to the Orange Book in the US.

Patent certifications: generic applicants (ANDA applicants) must submit certifications for each patent listed along with the ANDA.

Right to sue: patentee and MAH have the right to file lawsuits against type 4 certification.

Waiting period: a waiting period is triggered by the lawsuit during which period the ANDA cannot be approved.

Market exclusivity: a period of market exclusivity shall be granted for the first chemical generic drug that successfully challenges the patent and is approved for marketing.

Meanwhile, there are notable differences between the patent linkage systems in China and the US, as follows:

Notification obligations: generic applicants in the US must notify the patentee or MAH of type 4 certification, while there are no penalties for the generic applicants in China if they do not inform the patentee or MAH as required.

Waiting period: the waiting period in China is nine months, while the waiting period in the US is 30 months, which can be extended or shortened based on court rulings regarding patent validity.

Market exclusivity for the first generic drug: the first generic drug to successfully challenge a type 4 certification receives a 180-day market exclusivity period, while the market exclusivity period in China is 12 months.

Dispute resolution methods: the patentee or MAH in the US is able to file patent infringement lawsuits with the federal court directly, while the patentee or MAH in China can take legal action before Beijing IP court (the civil action route) or request an administrative adjudication with the China National Intellectual Property Administration (CNIPA) (administrative adjudication route) instead.

Summary of the related cases of the patent linkage

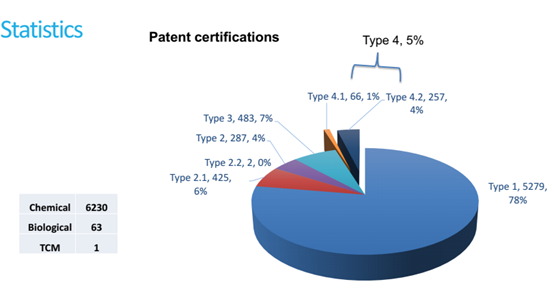

Figure 2, below, shows statistics on patent certifications in chemical, biological or traditional Chinese medicine (TCM):

Figure 2

Statistics on cases with administrative adjudication

The result or decision of the administrative adjudication normally concludes in the following manner:

the generic drug falls or does not fall within the scope of the disputed patent;

the patentee or MAH withdraws the request of administrative adjudication on their own initiative and therefore the examination of the case terminates; or

the request for administrative adjudication is rejected by the CNIPA due to the disputed patent being fully invalidated or, rarely, the disputed patent not being eligible for listing on the platform (eg, patents for crystal forms or a patent being invalidated).

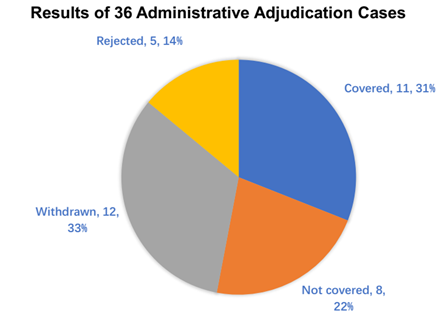

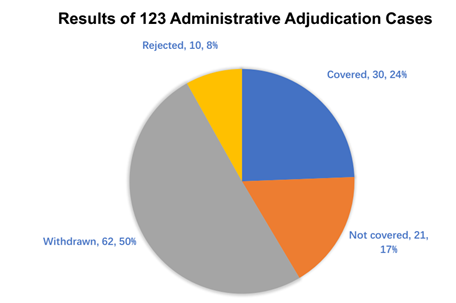

The below results/decisions of the administrative adjudication are the authors’ own statistics based on CNIPA data up to January 2023 (Figure 3) and May 2024 (Figure 4).

Figure 3

Figure 4

As seen from the above data, numbers of cases of generic drugs covered by the patents are higher than those not covered in Figure 3 (31 per cent versus 22 per cent), similar to the trend of cases in Figure 4 (24 per cent versus 17 per cent). Interestingly, in nearly 33 per cent of the cases in Figure 3, the patentee/MAH voluntarily withdrew the request for administrative adjudication, while the trend for cases withdrawn by the patentee/MAH increased by approximately 50 per cent in Figure 4 (50 per cent).

From the cases (2021–2023 and 2021–2024) available from the CNIPA, we conclude that the ratio of cases of generic drugs covered by the patents relative to those not covered remains unchanged in Figures 3 and 4 (approximately 1.4 fold). However, the cases withdrawn by the patentee/MAH significantly increased. The reason might be that more generic applicants change the formulation of the generic drugs in order to fall out of the scope of the patent and therefore the patentee/MAH determined that the generic drug was not covered by the patent after reviewing confidential materials, including the formulation of the generic drug obtained from the centre for drug evaluation (CDE). Alternatively, the patentee/MAH might have withdrawn the administrative adjudication cases so as to proceed with a parallel civil action instead of the administrative case.

The CNIPA often rejects a request because (1) the patent had been declared invalid in whole during the invalidation proceedings; (2) the patent certification is not type 4; or (3) the patent is not listable.

Patent linkage civil action

In addition to the judgment of the Supreme Court on the first patent linkage civil action (Chugai Pharmaceutical v Wenzhou Haihe Pharmaceutical, (2022) Zui Gao Fa Zhi Min Zhong No. 905), which was made on 5 August 2022, several judgments were made by the Court in term of the examination of the procedural or substantial contents in patent linkage (eg, (2022) Zui Gao Fa Zhi Min Zhong No. 2177, (2023) Zui Gao Fa Zhi Min Zhong No. 2, (2023) Zui Gao Fa Zhi Min Zhong No. 7, (2023) Zui Gao Fa Zhi Min Zhong No. 1233, etc).

Summary of the substantial issues in patent linkage

Here are some conclusions that were drawn from patent linkage litigation cases (including both administrative and civil actions).

Burden of proof: the generic company has the burden to disclose the technical solutions of the generic drug. If the generic applicant fails to submit evidence in support of its allegation that the generic drug does not falls into the scope of the patent, the generic applicant must bear unfavourable consequences due to legal burden of proof (see (2023) Guo Zhi Yao Cai No. 0001).

The ‘all elements’ rule, doctrine of equivalents, prosecution history estoppel and disclosure-dedication doctrine all apply to patent linkage litigation cases. If at least one technical feature of the generic drug is not identical or equivalent to those in the claim of the patent, the generic drug does not fall into the scope of the patent. Where a technical solution has been deleted or abandoned by the applicant during the prosecution of the patent and the patentee is not allowed to include the technical solution in the scope of the patent during the administration adjudication (see, (2023) Guo Zhi Yao Cai No. 0015/0023).

If the involved claims of the patent have been deleted during the invalidation proceedings, the related administration adjudication will be rejected by the CNIPA accordingly (see, (2023) Guo Zhi Yao Cai No. 0062).

If the involved patent has been invalidated and determined by the court in the second instance and therefore the patent right should be deemed to be non-existent from the beginning. As such, the patentee is not qualified as the party to take legal action and the court may reject the appeal (see (2022) Zui Gao Fa Zhi Min Zhong No. 2177).

If the technical solution of the originator drug does not fall within the scope of the patent of the patentee or interested party, the appeal filed by the originator drug should be rejected by the court (see (2023) Zui Gao Fa Zhi Min Zhong No. 2).

A patent for crystal forms or the use of crystal forms is not eligible for listing. If a claim covers the use of a crystal form, said claim does not belong to compound patent containing the pharmaceutical active ingredient, pharmaceutical composition patent or use patent (see, (2023) Zui Gao Fa Zhi Min Zhong No. 7).

The term ‘related patent’ in article 76 of the Patent Law should be construed as ‘the patent that had been marketed in China and corresponds to the generic drugs listed in the patent information registration platform of the CDE’. The patent relates to capsules instead of the tablets that had been marketed in China. As such, the patentee is not qualified as the party to take legal action (see, (2023) Zui Gao Fa Zhi Min Zhong No. 1233).

The implications for pharmaceutical patent strategies in China

Patent linkage litigation is fast, efficient and effective

Patent linkage litigation has some important advantages over normal patent litigation. First, patent linkage litigation can usually be concluded in a very fast manner. The CNIPA normally issues decisions in nine months and the CNIPA’s decisions can be used to stop the approval of generic drugs in the National Medical Products Administration (NMPA). Second, in patent linkage litigation, the generic company has the burden to disclose the technical solutions of the generic drug, and where the generic company fails to do so it has to bear unfavourable consequences. Therefore, patent linkage litigation is efficient for the patentee as the patentee is relieved of the burden to prove that the generic product infringes the patent, which can be burdensome and time-consuming. Last, patent linkage litigation is very effective as the NMPA will not approve the generic product until expiration of the patent if a CNIPA’s decision confirms coverage of generic product by the patent. Therefore, it is advisable for the patentees and MAH to take full advantage of the patent linkage in China.

Filing new drug applications almost simultaneously in China and other countries

To take full advantage of patent listing and other pharmaceutical IP protections in China, it is suggested that when developing new drugs and applying for new drug marketing authorisations, brand-name pharmaceutical companies should conduct simultaneous global research and development, and almost simultaneously file new drug marketing applications in China and in other countries. In particular, to utilise the patent linkage, all drugs, dosage forms and strengths should be approved in China as soon as possible after they are approved in other countries. Otherwise, any drugs, dosage forms or strengths that are approved in other countries but not approved in China will not be qualified for patent listing, resulting in no patent linkage being available to those particular drugs, dosage forms and strengths.

Monitoring of patent certifications and request for correction of patent certifications

Although the generic companies are supposed to inform the MAH of patent certifications, in practice, the generic companies did not do so and the generic companies’ failure to inform lacks remedy for the MAH. Therefore, it is very important for the MAH to monitor the patent certifications published in the patent linkage platform. Furthermore, if patent certifications are not correct, the MAH should request the NMPA to correct them because only type-4 patent certifications can be sued.

Future strategic steps

The originator drugs must face the patent cliff when a lucrative patent expires and more generic companies share the market sales due to their relative low prices, which are attractive to the centralised drug procurement. In this regard, the originator drugs should actively initiate the patent linkage litigation and respond to the validity challenge, and take advantage of PTE (for example, selection of patents for different dosage forms and indications; adapting the filing strategy of the patent family to the drug NDA approvals such as indication expansion; and filing of divisional applications) to reasonably extend the patent term.

Accreditation: “This article was first published on IAM in June 2025; for further in-depth analysis, please visit IAM The Guide to Life Sciences: Key issues for senior life sciences executive 2025"